Domestic miner ARES Strategic Mining (CSE: ARS, OTC: ARSMF, FRA: N8I) has recently managed to elevate its Utah-based Fluorspar project into a major opportunity.

With a massive high-grade fluorspar orebody ready to mine and two processing plants underway, ARES are transitioning from a relatively obscure junior miner, to a significant domestic producer of a critical mineral. And, it’s happening right now.

ARES is perfectly positioned to capitalize on the seemingly insatiable demand for fluorspar – a mineral you’ve probably never heard of, but is in just about everything. Aside from its uses in industry, it’s also essential to the production of lithium-ion batteries (hello Elon!) and the exploding markets of nuclear and AI.

The kicker: ARES Strategic Mining has also located two additional high-value Rare Earth Minerals, germanium, and gallium, at its Lost Sheep Mine in Utah.

Introducing ARES Strategic Mining

ARES Strategic Mining is mining company focused on bringing domestic U.S. Fluorspar to market. Its efforts are aimed at the growing market for Fluorspar (a U.S. critical mineral). They own the Lost Sheep Mine which covers some 5,982 acres in the Spor Mountain District – representing the only permitted U.S. Fluorspar mine.

Over the past 24 months, ARES Strategic Mining has put the key components in place at its Lost Sheep Property in Juab County, Utah. The Lost Sheep Mine offers an incredibly rich grade of Fluorspar; indeed, it hosts the highest naturally occurring Fluorspar grade in the USA and is accepted by the industry, even in an unprocessed form. The manufacturing operation will be the first of its kind in the country, allowing ARES to return an entire industry to the United States.

ARES Answers Industry Demand

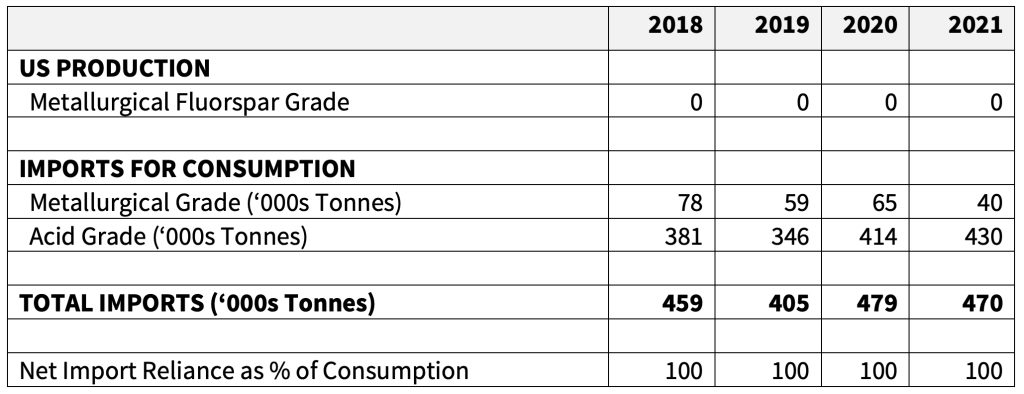

Fluorspar – also known as fluorite or technically referred to as calcium fluoride (CaF2) – is difficult to source, and the major producing regions are all outside of the US, including China, Mexico, Mongolia/CIS, and South Africa. At present, America has a 100% net import reliance on Fluorspar used for consumption (see chart below).

To answer the need, ARES has been investing in developing and upgrading its Lost Sheep Mine facilities. It has now completed the ramp to the orebody, and is constructing a new high-capacity production plant nearby.

ARES acquired a significant commercial property in Delta, Utah, which is a town in close proximity to the mine site. The company is constructing two processing plants here – a lumps plant and a flotation plant. The lumps plant will produce ‘briquettes’ of fluorspar, typically sold to industry, while the flotation plant will produce acidspar and other high-grade products.

In addition to the facilities, ARES has already completed a strategic rail spur project to connect the operation to distribution routes, which will aid in the delivery of products from the Lost Sheep Mine all across North America.

100% Foreign Dependency on Fluorspar

The global fluorspar market is valued at US$ 1.78 billion in 2023 and is forecasted to reach US$ 2.8 billion by the end of 2033, expanding at a CAG of 4.5% from 2023 to 2033. Unfortunately, the U.S. relies entirely on Fluorspar imports to satisfy its growing needs. Between 2018 and 2022, the US import sources were:

• Mexico – 66%

• Vietnam – 16%

• South Africa – 7%

• Canada – 7% and

• Other – 4%

In addition, China, the largest producer of Fluorspar worldwide, has continued to restrict its imports, choosing instead to use its Fluorspar production for domestic Chinese applications. This unusual turn of events has set into motion a real and serious need for strategically located sources for US Fluorspar

(Source: USGS)

Fluorspar Rated a Critical Strategic Material

In 2018, the US Government declared Fluorspar a strategic and critical material in the United States. The mineral qualifies as a critical mineral because it has been identified as a mineral material that is essential to the economic and national security of the United States, the absence of which would have significant consequences for the economy or national security.

Fluorspar – A 60 Second Primer

Fluorspar is a critical mineral used in a wide range of industries, including steel, aluminum, and cement production, as well as in the manufacturing of lithium batteries. The critical mineral is essential to the production of lithium batteries, which are vital to the powering of EVs. As the demand for EVs continues to rise, so too goes the demand for fluorspar. The U.S. imports 100% of its high-purity fluorspar, making it reliant on foreign suppliers. This situation has prompted the U.S. government to list fluorspar on its strategic reserves, highlighting its importance to the nation’s economy.

In its natural state, fluorspar presents in various colors, including purple, green, yellow, and blue. While it has many applications, possibly the most important application of Acidspar (a higher grade version of Fluorspar) is its use in creating hydrofluoric acid for refrigerants, pharmaceuticals, electronics, and it is a vital element in lithium-ion battery production.

THE TWO GRADES OF FLUORSPAR

There are two principal commercial grades of fluorspar (CaF2) produced worldwide:

• Metallurgical spar is graded from 60% to 96% purity and is currently valued at about US$360 per metric ton (source: statists).

• Acid-spar, graded over 97% purity with a current market value of about US$550 per metric ton (source: ARES Mining Data).

The metallurgical grade fluorspar or ‘met-spar’ accounts for approximately 35-40% of total fluorspar production, with principal applications in steel production as a flux to lower the melting temperature and to help the absorption and removal of Sulphur, phosphorus, carbon, and other impurities in the slag, as well as in cement to speed up the calcination process.

Acid-grade fluorspar or Acidspar accounts for approximately 60-65% of total fluorspar production, with the principal applications of aluminum production, the manufacture of hydrofluoric acid (HF) – the primary source of all fluorochemicals (the single largest consumer of fluorspar), used in fluorocarbons for refrigerant gases, propellants, electrical and electronic appliances, lithium batteries, pharmaceuticals, polymers, and agrochemicals and as a petrochemical catalyst.

Fluorspar’s Critical Role in Lithium Batteries

Fluorspar is critical in manufacturing lithium batteries as it is used to produce lithium hexafluorophosphate (LiPF6), a key component of the electrolyte in rechargeable lithium-ion batteries. LiPF6 dissolves in the battery’s liquid electrolyte, which allows lithium ions to move between the cathode and anode during charge and discharge cycles.

In addition to LiPF6 production, fluorspar is also utilized in the production of aluminum fluoride, which is necessary for fluoride-ion battery technology. Fluorspar is also a source of fluorine, an essential element in manufacturing carbon electrodes used in lithium-ion batteries.

Overall, fluorspar is critical in manufacturing lithium batteries as it plays a crucial role in improving battery performance, increasing energy density, and extending battery life.

Newly Discovered Rare Earth Minerals Add Another Dimension

In August 2023, ARES released results that showed tests of previous assays from its Utah fluorspar project indicating occurrences of the rare earth minerals germanium and gallium.

Germanium and gallium minerals are at the center of the US-China Trade Dispute. That’s because China is restricting exports of two niche metals that are key to manufacturing electronics and semiconductors as the tech battle with the U.S. and Europe heats up.

Germanium and Gallium Minerals are at the center of the US-China Trade Dispute. That’s because China is restricting exports of two niche metals that are key to manufacturing electronics and semiconductors as the tech battle with the U.S. and Europe heats up.

China currently produces 60% of the world’s germanium and 80% of gallium, according to the Critical Raw Materials Alliance (CRMA).

Gallium is used to make gallium arsenide for use in electronics. According to Chinese customs, China exported 94 metric tons of gallium in 2022, up 25% from the prior year. According to USGS, U.S. imports of gallium metal and gallium arsenide (GaAs) wafers in 2022 were worth about $3 million and $200 million, respectively.

Germanium ores are rare, and most germanium is a by-product of zinc production and from coal fly ash. China produces around 60% of the world’s germanium, according to CRMA, with the balance coming from Canada, Finland, Russia, and the United States. According to Chinese customs, China exported 43.7 metric tons of unwrought and wrought germanium last year. Roughly $39 million worth of germanium was consumed in 2022, up 10% from 2021, according to the U.S. Geological Survey (USGS).

So, while ARES remains focused on its core project of producing high-purity Fluorspar, these Rare Earth Minerals could prove worth pursuing as part of production plans and add tremendous value to the Lost Sheep property.

Data Supports ARES Strategic Mining’s Efforts

A NI 43-101 report issued in 2020 confirms Fluorspar grades averaging 87% at the Lost Sheep site, which is higher than the industrially processed grades from Mexico and Vietnam. Keep in mind that typical fluorspar mines only have grades of 5% – 30% purity. The mine also requires very low start-up capital and investment in return for a significant boost in production.

From here, ARES has a relatively straight shot to achieve significant production and a much higher valuation.

U.S Government Supports ARES Strategic Mining’s Efforts

Not to be overlooked, ARES has managed to beef up its development with a financing of US$4.42 million from the U.S. Department of Agriculture in 2023 to support its strategic plan. In April 2024, ARES closed on non-dilutive financing to exclusively develop the Company’s manufacturing operation at its processing site in Delta, Utah.

ARES’ Next Steps

Here are the company’s next steps, as confirmed in their 2024 Outlook video:

• Continue drilling to hit the main fluorspar ore body

• Extend mine ventilation to the ore body

• Complete installation of lumps plant (foundations have been poured and steel beams raised)

• Commence installation of the flotation plant (already purchased)

• Process fluorspar and expand production to +5,000 tonnes of acidspar per month

Scaled Production, Increased Value, and Solid Financing

ARES Strategic Mining represents a unique opportunity for investors looking to get in at the early stages of a critical mineral production company. Very few domestic critical mineral plays are in the market, and as the intense international climate escalates, ARES Strategic Mining is attracting attention and picking up pace. Despite its unique position and rapid advancements, ARES remains in the relatively early stages of the life cycle of a mineral production company. Investors often view that as the “sweet spot” before major production.

The Lost Sheep Mine’s low production costs will make it the most competitive supplier of fluorspar in the US, compared to foreign producers. With the financial backing of both the State and Federal governments, and with the guidance of a highly qualified leadership team, ARES looks likely to scale rapidly. It is worth noting, that any additional financing required for expansion can be achieved within several months of operations commencing.

Expansion will enable ARES to increase production and purity of material from metspar (<97%) to acidspar (+97%). Acidspar is currently priced at US$550/tonne. So, with minimal expansion capital required, ARES expansion can dramatically increase revenue and margins.

The company has already strategically executed its plans for the Lost Sheep Mine and Facilities Plant. They plan to begin producing the more available metspar first in order to create immediate revenue from the mine. They can then quickly scale up production and refining capabilities to produce higher-value Acidspar.

ARES has top-notch mining expertise and mine development coordinated with highly respected contractors and partners. It has already negotiated and signed offtake agreements (the agreement to buy products as soon as they become available).

IN SUMMARY

The increasing demand for high-grade fluorspar and the growing need for lithium batteries, nuclear and AI data centres, gives ARES Strategic Mining a compelling investment case. The company’s flagship Lost Sheep Mine, coupled with its recent additional potential for Rare Earth Minerals, positions ARES for considerable upside in the near term with a long life value.

Company Profile:

ARES Strategic Mining

Symbols: CSE: ARS | OTC: ARSMF | FRA: N8I1

Market Cap: USD 19.96 Million

10 Reasons to Consider ARES Strategic Mining (CSE: ARS OTC: ARSMF) as One of the Best Junior Opportunities in the Domestic Mining Space:

1. High Purity Fluorspar: ARES’ Lost Sheep Mine has one of the highest purity fluorspar deposits in the world (97% CaF2), a significant competitive advantage. The company is producing fluorspar products specifically for the chemical and aluminum industries, which are higher-priced and in high demand.

2. Strategic Domestic Location: ARES’ Fluorspar mine is in Utah, a stable and mining-friendly jurisdiction with infrastructure advantages, including excellent transportation links and a skilled labor force.

3. Diverse Customer Base: ARES has signed several memorandums of understanding with diverse customers, including specialty chemical companies, aluminium smelters, and cement producers, providing a robust customer base for its fluorspar products.

4. Short-Term Revenue Potential: ARES is in the advanced stage of completion of its mine plan, and the construction of its process plant has begun. Hence, it generates revenue in the short term while increasing its long-term value.

5. Long-Term Upside Potential: The Lost Sheep Mine has excellent potential for expansion, pushing the estimated mine life beyond the projected 20 years, thereby creating an opportunity for increased returns for investors.

6. Rare Earth Mineral Potential: Newly discovered occurrences of the rare earth minerals germanium and gallium appeared in assays from the Lost Sheep Mine conducted by SGS. These materials are critical to semiconductor and hi-tech production.

7. Financing in Place: ARES Strategic Mining completed financing of $4.42 million in early 2023 from the US Dept. of Agriculture. This assures the needed capital for its new tailings facilities and transformative operations.

8. Growing Demand for EVs: As mentioned, fluorspar is a critical mineral needed for the production of lithium batteries, which are an essential component for the powering of EVs. With the increasing demand for EVs globally, the demand for fluorspar will continue to rise.

9. Future Market Potential: The price of fluorspar is expected to spike as new domestic sources are not expected to come online, potentially creating a supply deficit. The timing is opportune for ARES’ mining operations to begin producing a critical commodity with rising demand and very limited supply.

10. Strong Management Team: ARES’ management team has a wealth of experience in the mining industry and has led various successful projects in the past. This team is instrumental in advancing ARES’ mining projects and bringing them to a profitable stage.

Sources