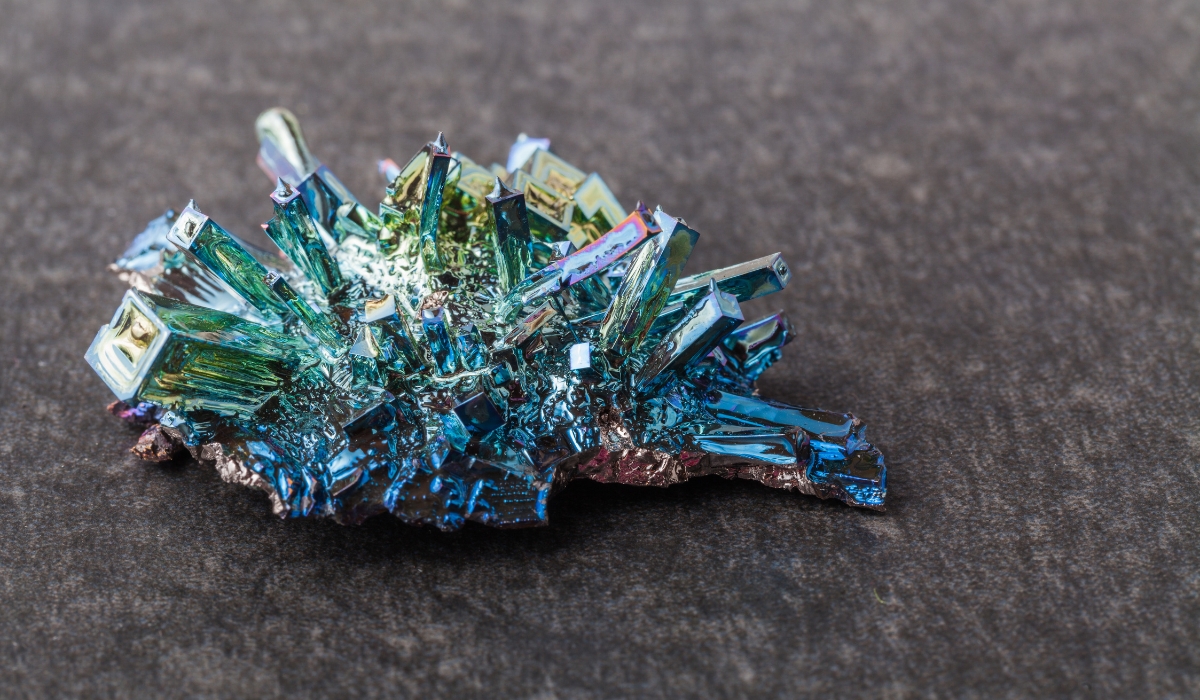

Bismuth — an often-overlooked but critical metal used in pharmaceuticals, alloys, and defense applications — has soared to its highest price in over a decade following newly imposed export restrictions by China.

The metal, which is also used in coatings, batteries, and lead-free soldering, has surged 38% to $8.25 per pound since the curbs were implemented on February 4, according to data from Fastmarkets. The new controls require Chinese exporters to obtain government authorization before shipping the commodity overseas, further tightening an already limited supply.

The commodities market has been in turmoil amid ongoing trade disputes and protectionist measures. Beijing’s move follows an escalating pattern of economic standoffs, with China previously restricting exports of other critical minerals, including gallium and germanium.

Bismuth, which China produces in overwhelming majority, has now become the latest focal point of the geopolitical tug-of-war.

“Chinese bismuth ingot exports are expected to come to a near halt in the short term as exporters work through the new licensing process,” said Chen Qiqi, an analyst at Mysteel Global, as quoted by Bloomberg.” Chen added that traders are stockpiling the metal, anticipating further price surges.

The impact of these restrictions is already being felt across industries reliant on the metal, including medical and electronics manufacturing. With demand holding firm and supply chains tightening, consumers are bracing for additional price volatility in the months ahead.

Bismuth ingot prices in China have jumped 7% to 88,000 yuan ($12,137) per ton since the curbs were enacted, according to Asian Metal Inc. As global buyers scramble to secure supply, the broader implications of these restrictions could stretch far beyond the specialty metals market.

Earlier this month, Lewis Black, CEO of North America’s Almonty Industries, noted that his clients were in ‘a state of disbelief’ following Beijing’s export controls on tungsten. ‘It’s a warning shot, because we cannot exist without it,’ Black said. ‘Our economy, manufacturing, defense—everything depends on it. Yet, Russia, China, and North Korea control about 90% of the output.’

With economic nationalism reshaping trade flows and resource security climbing up political agendas, the Trump administration has emphasized the urgency of fortifying domestic supply chains. This includes accelerating investment in domestic mining, processing, and recycling operations to mitigate the impact of future mineral bans from China.